INCOME-PRODUCING INVESTMENT REAL ESTATE

MULTI-FAMILY | MEDICAL / OFFICE | SINGLE TENANT | MIXED-USE | SIMILAR

FOR THOSE OF YOU CONSIDERING DIVERSIFYING BEYOND STOCKS AND BONDS, INCOME-PRODUCING REAL ESTATE IS AN ASSET CLASS ALL SERIOUS INVESTORS SHOULD ASSESS AND CONSIDER.

Though many/most of our clients are more heavily weighted in income-producing investment real estate, the “typical” asset allocation for our clients includes a combination of investment real estate, stocks, bonds, gold (other inflation hedges) and alternative investments (hedge funds, private credit, private equity, alt funds, art, wine, fine jewelry and more).

WHY INCOME-PRODUCING INVESTMENT REAL ESTATE?

Real estate is one of the fastest and safest ways to build wealth and grow your net worth in the United States. To be clear, I am referring to positive cash-flowing rental property (not real estate that takes money out of your pocket every month).

It is widely documented that approximately 90% of all millionaires gained their wealth through real estate.

But a surprising number of high-net-worth individuals are over-invested in the stock market. Some associate real estate with risk or complexity. For many, stocks seem less intimidating and thus an easier path to default to.

But the fact is that bear markets emerge every 3.5 years on average – with a corresponding average loss in value of 35% per bear market. Residential and income-producing investment real estate is a logical hedge against the highly repetitive bear market cycle. It’s another vital cylinder you should have firing under the hood of your investment portfolio.

If you’d like a dramatic example of that reality, look no further than the latest bear market beginning in early 2020. Coincidental with more than two years of stagnant stock performance, residential real estate was subjected to one of the most extraordinary investment stress tests imaginable, courtesy of the COVID crisis.

Despite federal, state, and local governments across the U.S. barring landlords from evicting tenants for non-payment of rent, rent collections measured consistently between 94.9% to 95.8% throughout COVID compared to a pre-pandemic average of 96%. During this period residential rents went up. Residential real estate values went up. And correspondingly, the net worth of residential real estate investors went up, all during a time many viewed as apocalyptic.

Income-producing investment real estate is subject to cycles just as any investment sector is. But its cycles often run counter to stock market cycles, adding to its value as a protective hedge for your portfolio.

THERE ARE SEVEN-(7) MAIN REASONS TO INVEST IN INCOME-PRODUCING REAL ESTATE:

List of Services

-

1) Passive Cash FlowList Item 1

Tenants pay rent. After expenses, what you have left over is passive cash flow. What truly builds wealth is creating multiple streams of income not connected to your time. This is something that differentiates real estate investments from stocks. Typically, a stock investor only makes money when you sell the stock (assuming the share price has gone up).

-

2) AppreciationList Item 2

Over the long-term, the value of real estate will nearly always go up (real estate is an inflation-hedging investment). This happens while the loan is being paid down, so as your property gains value, your equity and net worth increase. Sometimes appreciation is just a product of growth in the market, but with income-producing investment real estate, appreciation can be “forced” and accelerated by making improvements in a property to increase rents and/or reduce expenses.

-

3) Federal Tax Benefits

Because of the many tax benefits to owning property, real estate investors often end up reducing their taxes overall even when bringing in more income. Operating expenses including property taxes and mortgage interest are deductible. Furthermore, an annual property depreciation deduction is also allowed further shielding the income generated. Utilizing the powerful IRC 1031 Exchange to defer capital gains when selling/buying/trading properties can also promote accelerated capital (equity) growth. The tax benefits are a primary reason many millionaires invest in real estate.

-

4) Leverage

The ability to leverage is one of the greatest benefits of real estate investment. There are four-(4) ways to use leverage to enhance your real estate investments. You can leverage with “OTHER PEOPLE’S MONEY” (yes, the bank is often the primary source of OPM). You can leverage with “TIME.” One example is to turn over day-to-day management operations to a property management company once the investment has been secured. You can leverage “OTHER PEOPLE’S EXPERIENCE.” This would include brokers, tax experts, property/asset managers, etc. You can leverage “THE PROPERTY ITSELF.” The more units, the more leverage. These economies of scale and minor changes can make an enormous difference.

-

5) Principle Pay Down

As you pay down your mortgage on a property (other people’s money), equity and more wealth are being built at the same time positive cash-flow is being generated. In substance, your tenants are paying your mortgage for you.

-

6) Refinance

This is when you put a new mortgage on a property you already own. As the equity grows in a property, some of this equity can be pulled out and reinvested in another property, tax free (a refinance is a non-taxable event). By incorporating this strategy an investor will in time own enough property to create enough passive income to comfortably live on and more. At Realty Yield, over the last 20+ years we have helped many real estate investors reach this level of financial independence.

-

7) Can be a “Feel Good” Business

When a real estate investor invests in a property and makes it better to increase their investment returns, in most cases, the property becomes a better place for tenants, neighbors and the community at large too.

REALTY YIELD HAS COMPILED SOME HISTORICAL DATA FOR POTENTIAL INCOME-PROPERTY INVESTORS TO REVIEW AND ASSESS.

REPRESENTATIVE REAL ESTATE INVESTMENT RETURNS VS. STOCKS & BONDS

ACTUAL annual investment returns realized by Realty Yield clients over the past 20+ years:

- Annual pre-tax cash flow - (3-6%)

- Annual after-tax cash flow - (2-8%)

- Annual after-tax cash flow + principal pay down on mortgage loan - (5-12%)

- Annual total return (after-tax cash flow + pay down on mortgage loan + realized capital appreciation) – (12-22%)

NOTE/DISCLAIMER: Market conditions, interest rates, macro/micro economic factors as well as the personal financial situation of the investor will all factor into the actual investment returns realized.

HISTORICAL ANNUAL PRE-TAX RETURNS on STOCKS, BONDS & GOLD

| HISTORICAL ANNUAL RETURNS EQUITIES (Stocks) | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 14-Year Average | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | |

| Dow Jones | 10.26% | 12.88% | 13.70% | -8.78% | 18.73% | 7.25% | 22.34% | -5.63% | 25.08% | 13.42% | -2.23% | 7.52% | 26.50% | 7.26% | 5.53% |

| S&P 500 | 12.76% | 23.31% | 26.29% | -19.44% | 26.89% | 16.26% | 28.88% | -6.24% | 19.42% | 9.54% | -0.73% | 11.39% | 29.60% | 13.41% | 0.00% |

| Russell 1000 | 12.55% | 22.84% | 24.51% | -20.41% | 24.76% | 18.87% | 28.89% | -6.58% | 19.34% | 9.70% | -1.09% | 11.07% | 30.44% | 13.92% | -0.51% |

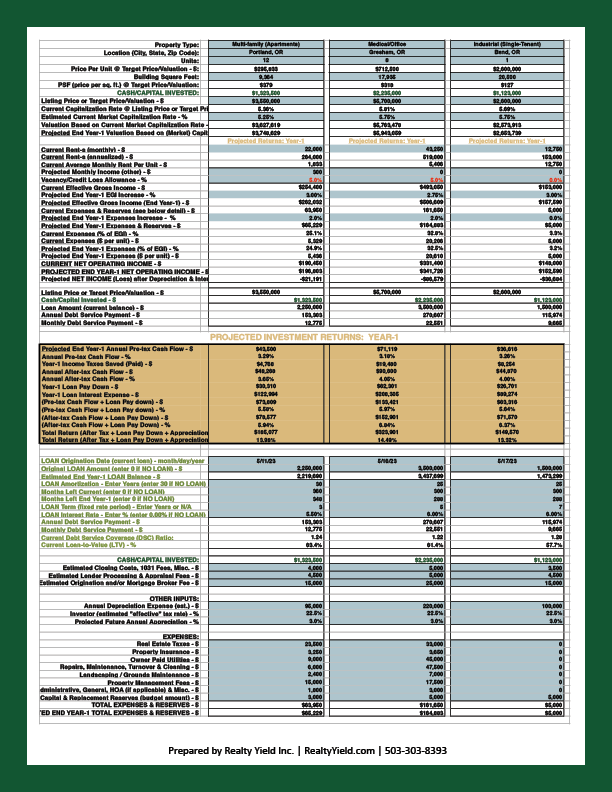

INCOME PROPERTY INVESTMENT RETURN ANALYSIS & PROJECTIONS MODELING

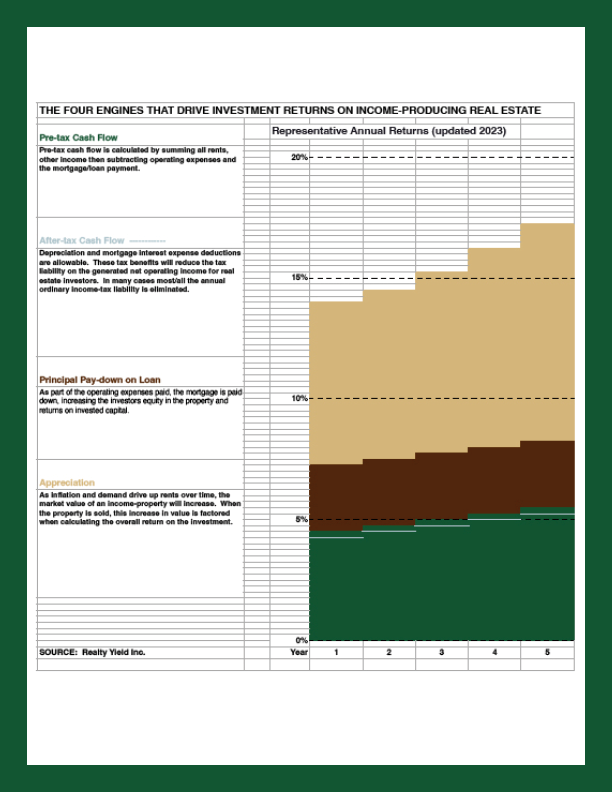

FOUR PRIMARY ENGINES IMPACTING INVESTMENT REAL ESTATE RETURNS

Four Primary Engines Impacting Investment Real Estate Returns

- Pre-tax cash flow, (Income less operating expenses less mortgage loan payment)

- After-tax cash flow (Factoring the income tax burden)

- After-tax cash flow + principal pay down on mortgage loan (Factoring the debt/loan effect on investment yield)

- Total return (Factoring projected appreciation)

Cumulatively, these four drivers impact the total return of income-property real estate investments. Additionally, if applicable, a tax basis computation is calculated for even greater accuracy.